Managing August’s Finances

Consulting is a simple business, with few logistical or financial challenges to master. Even so, we take operations pretttty seriously at August. Probably more seriously than most businesses of our size, but that’s what makes us great. Right?

Over the last 18-ish months, we have developed five spreadsheets that we use on a daily basis to track how our business is performing — and to signal to the rest of the team how they should be spending or saving resources. All of these sheets are open and editable by anyone on our team, and they’re in one Google sheet.

For all of the below, the screen captures are of actual numbers for 2017, as of late January. We don’t share these sheets in public because they contain clients’ and individuals’ names.

Managing Cash

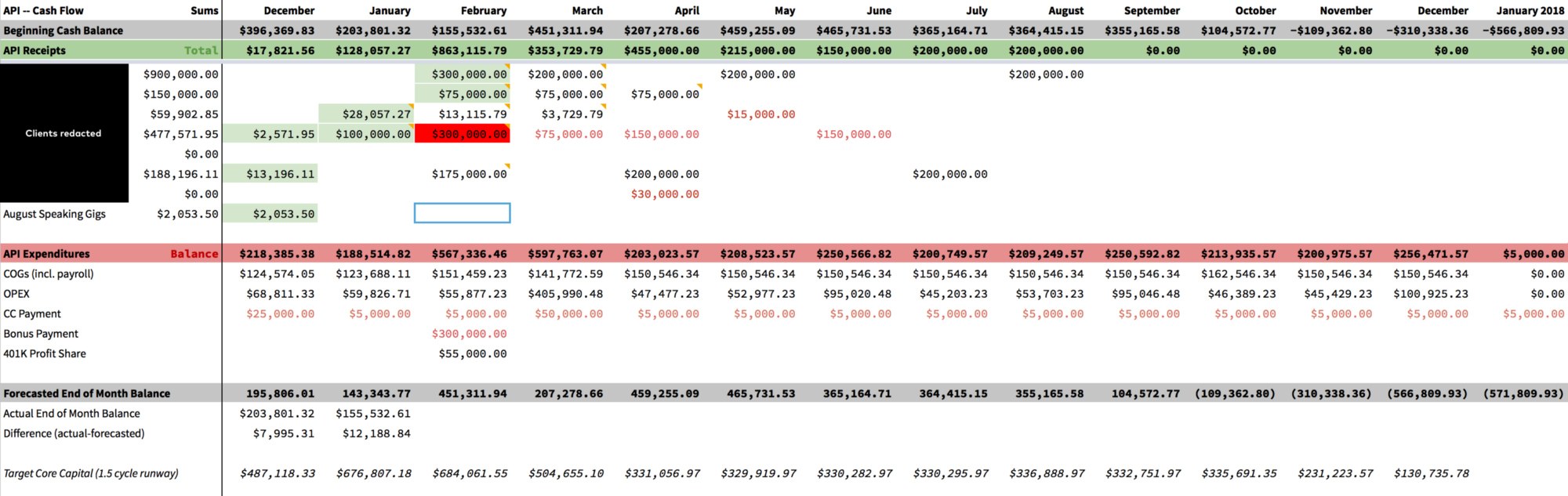

First, and most important: our month-by-month overview of cashflow.

This is a pretty simple document:

- Incoming cash goes in the top rows (“API Receipts”) and outgoing cash goes in the lower rows (“API Expenditures”), with all outgoing cash tracked in separate, connected sheets;

- Each section is summed in the green and red rows, and the difference drops down to the grey row as our expected end-of-month bank balance;

- In general, only signed business with invoice dates go into the API Receipts section;

- We track actual bank balances to see how well we’re budgeting, and we also calculate a “Core Capital” value that we try to keep in the bank — 1.5 months of expected expenditures; and

- Things move around — payments are occasionally late, expenditures move up, grow, and shrink, so we’re constantly updating this sheet.

This is a must-have spreadsheet for entrepreneurs — it’s been huge for us.

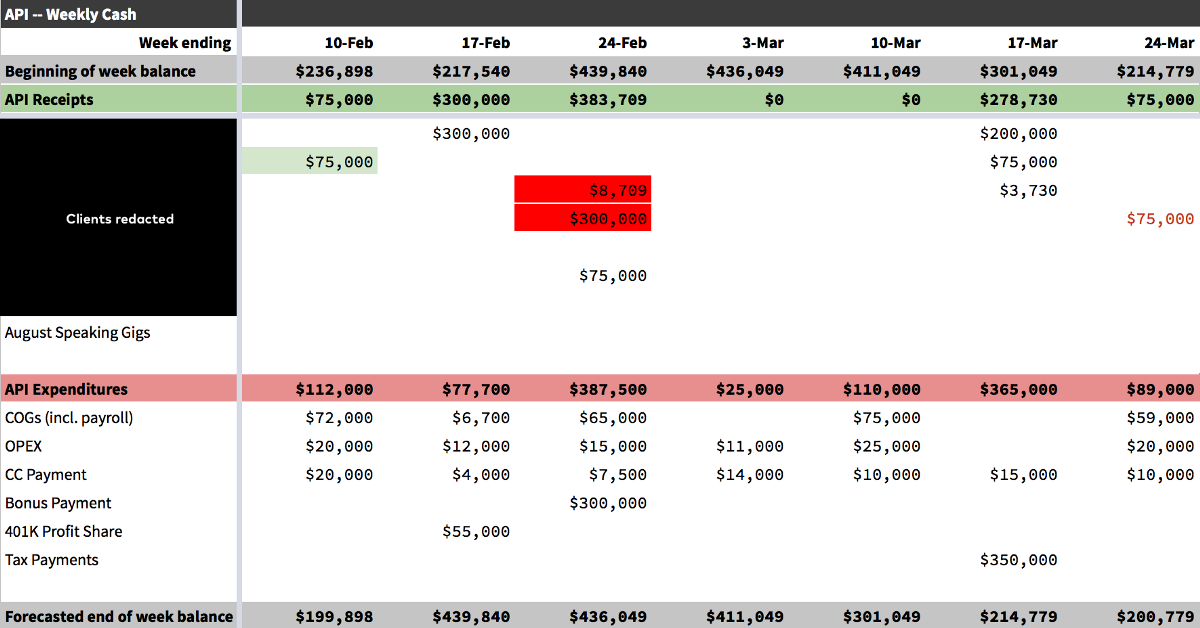

We found that a monthly view doesn’t have enough resolution for end-of-year and tax season, where we have a ton of incoming accounts receivable (close to one million dollars!) and a bunch of time-critical cash going out in bonuses and to federal, state, and local tax authorities.

So we made a weekly view!

It’s the same basic idea as the previous sheet, but updated more frequently, and with rougher cuts at the numbers. This lets us know if we’re going to be negative in any week, which is pretty important for us, given that we don’t have a line of credit yet.

As a result, this sheet drives big expenditures and our ongoing collections efforts.

Understanding the Business

The first two are active management sheets that guide day-to-day decisionmaking. The next two are bigger picture and represent an ongoing editorial view of the business: after all, cash is fact and profit is an opinion.

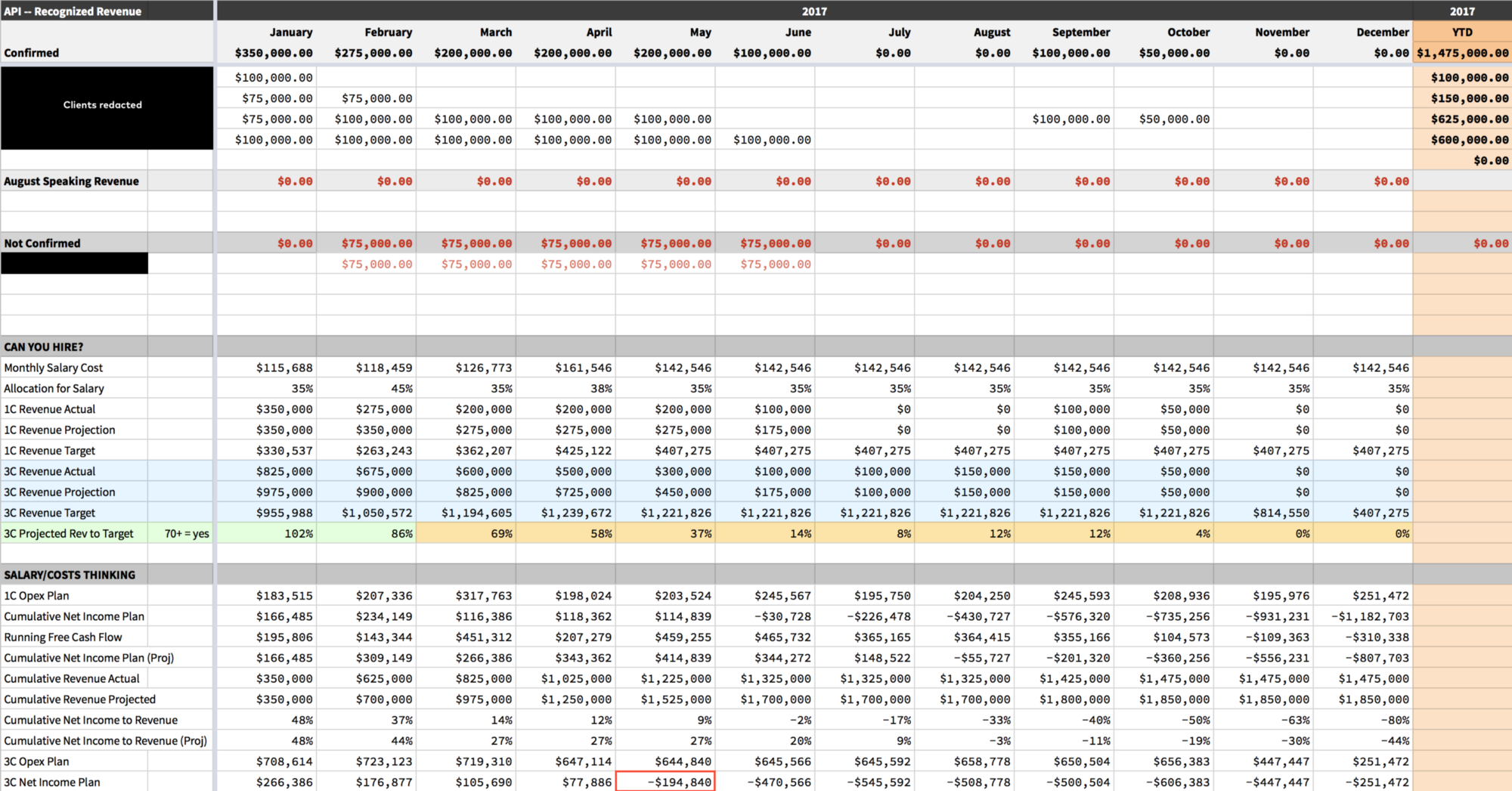

We use Recognized Revenue to drive a number of these opinions, and both projected and confirmed Revenue is tracked in the sheet below.

To make things interesting, we pull in:

- Total salaries

- Total operating expenses including salaries

- Our running Free Cash

Can you hire?

We use our salary load to drive our revenue target. Ideally our total salaries track with revenue — that is, they are a variable cost of revenue — and the portion of our revenue that we dedicate to salaries is the business model.

For all of 2016, we were targeting a 35% allocation of our revenue to salaries. We’ve recently decided to up that allocation to 45%, in favor of bringing more people onto the team and improving the quality of our product while decreasing our net margin (shooting for fewer projects with more people = less profit):

Salaries / Salary Allocation = Revenue Target

$140,000 / 0.45 = $311,111

versus

$140,000 / 0.35 = $400,000

There’s also a hiring trigger built in to this sheet: we let ourselves make a binding offer to a new member when our three-month revenue projection is 70% of target. The combination of 45% of revenue allocated for salary and a 70% target “bar” for hiring means we’re always trying to safely hire ahead of ourselves.

Note: a fun feature of working in public on finances is that folks are playing around in the sheet with different allocations to get an idea of how the business works…hence the differing values in that row.

Salary & Costs Thinking

These rows are our “advanced analytics” for the business and give us different views into how well we’re performing. For example: on one hand, we’ve got enough cash and A/R to last us into October. On the other hand, if we don’t sell any more work on top of the $1.4m we’ve already sold, we become unprofitable by June. None of these numbers are used to run the business — just different “opinions” as to how we’re doing.

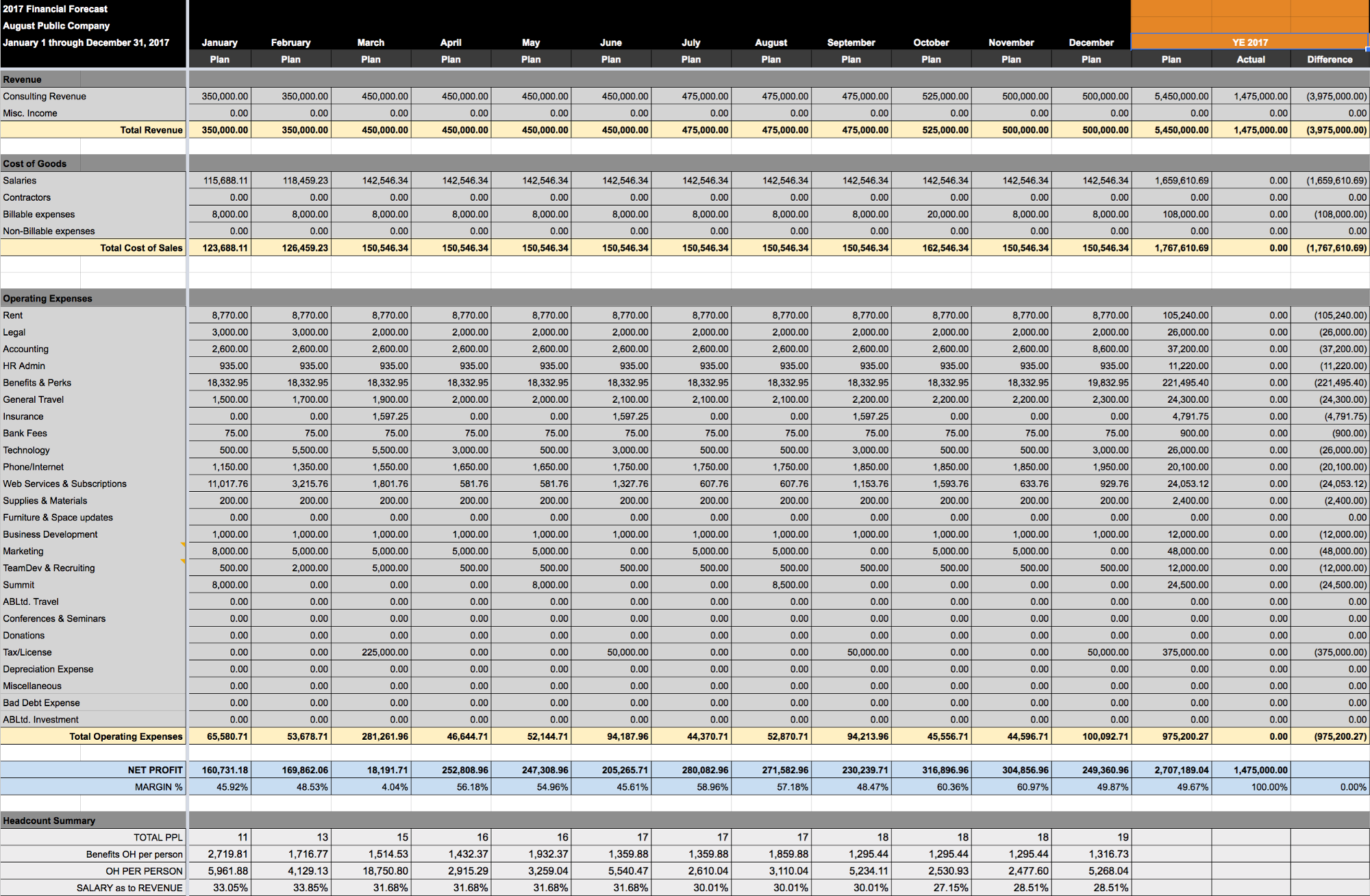

The P&L

Profit & Loss is important for us at certain moments (when we get an external valuation and plan for growth/tax) but doesn’t get a ton of attention day-to-day. So while we do periodically update this sheet, and track actuals from our accountants against our plan, but it’s not that consequential for managing the business.

Open Salaries

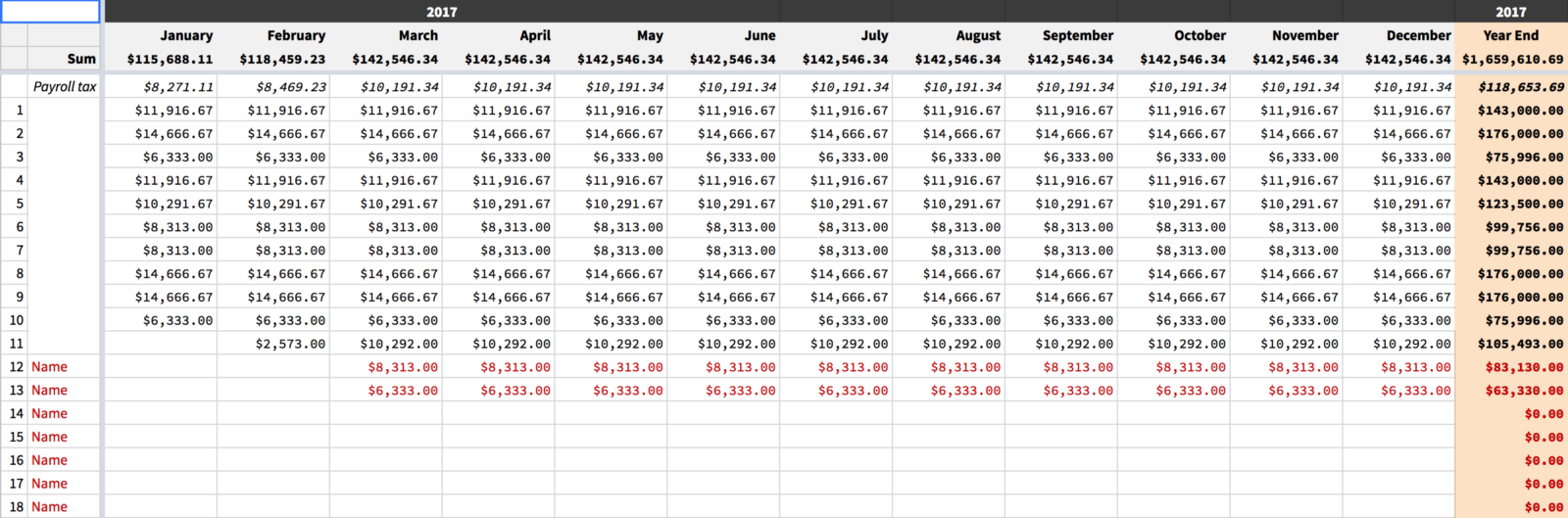

And finally, our salaries:

This is where we track how much we pay each other. Nothing really special here, save for the fact that this is public within the organization. The completed red lines represent planned hires, and the sums are included in our cashflow planning. As a result, our runway always includes planned growth.

Anyhow — that’s how we track our business, and Google Sheets is a critical part of making it work. As you can see, it’s mostly about predicting our short- and mid-term cashflow, which lines up with our bootstrapped, no-debt upbringings. We’re definitely looking for thoughts and advice if you’ve got it, and we’d love to see your sheets, too!

Comments