Bonuses At August

Occasionally in the course of running our business, we will create excess profits.

Excess? Profits? I thought we were a for-profit business!

Turns out you can have too much profit. For example, if you’re not expecting to have a big profit at the end of the year (because a new project comes in, say), you could have a big tax bill without the ability to pay it off. It could also mean that you were overcharging your customers, and are likely to face competitive pressure. Same thing applies to talent, but in the inverse: underpaying the team brings competitive pressure for your people. And lastly, it could mean that payment schedules and normal business operations didn’t mix super well over the course of the year, pushing the business to hoard cash to survive lean times.

In any case, mostly because of an awesome end-of-year project and conservative salaries through the year, we’ve found ourselves with around $300,000-$400,000 extra at the end of 2016. Bad. But also, neat! We get to figure out what we do when this happens.

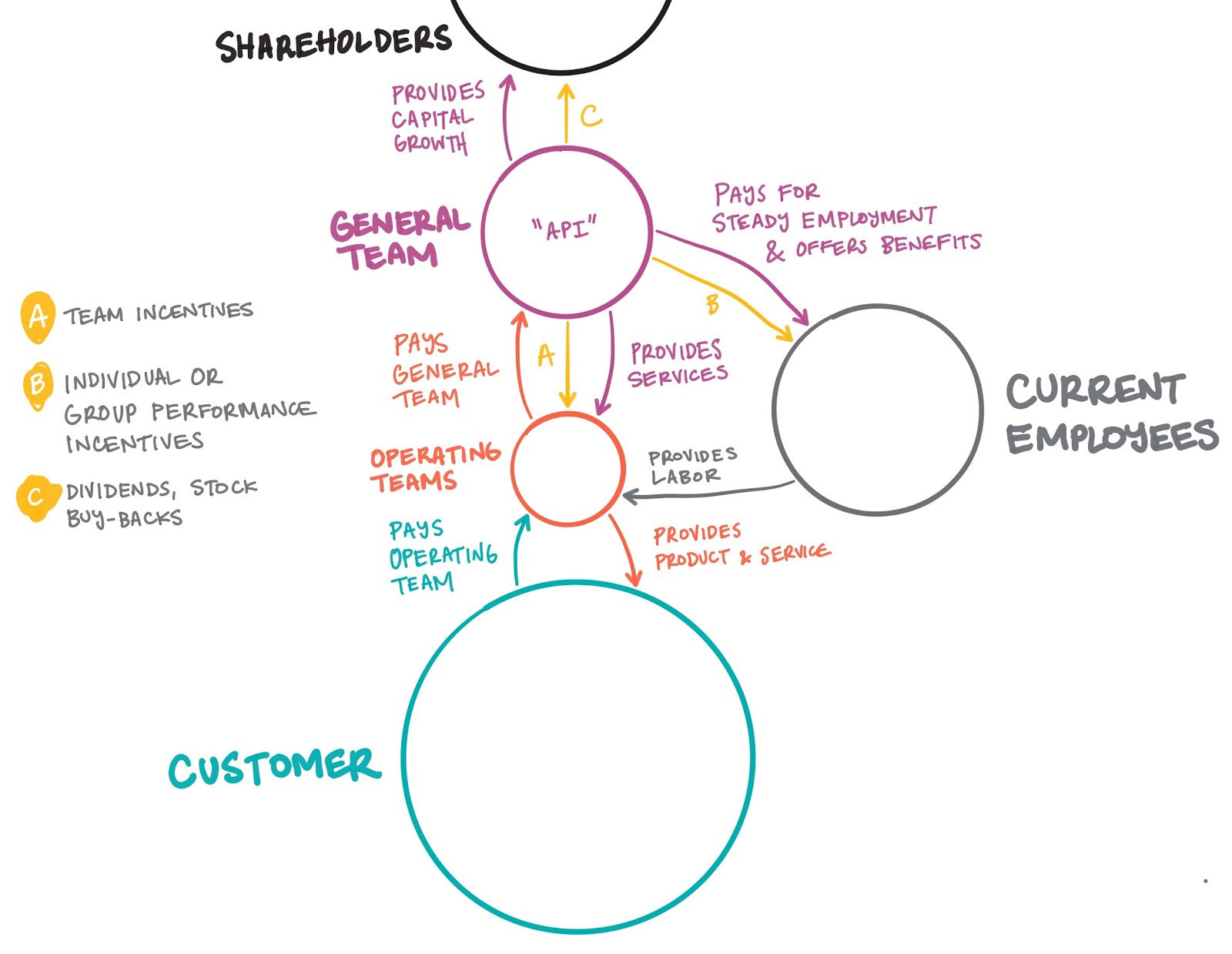

Customers pay our client teams (here “operating teams” to be generic) for our products and services.

The client teams pay the business (here the “general team”) for any centralized services that they might provide, and for the ongoing employment of and benefits for people that provide labor to the teams.

Because our teams are relatively fluid, with team membership changing in both planned and unplanned ways several times per year, I believe it’s useful to separate employment by the organization and team membership. Further, it’s easier to eliminate inequity if we manage employment and benefits centrally, rather than allowing the operating teams to do so themselves.

(That is, we have a mixture of planned and market economies happening at August.)

Of course, only a couple of those transactions happen in real life — the customer relationship is real, and the employment relationship is real — and the rest are simply a mental model that I find useful.

In any case, what happens when the general team finds itself with a bunch of extra profits at the end of the year? It can keep the money, and pay taxes on the earnings at ~39%. It can spend the money on investments or improvements to the business, or pre-pay for future services that it might need. It can donate some, or all, of its profits to a charity of the group’s choosing.

Or it can distribute the profits to the employees and shareholders of the business. This is my recommendation for how we move forward with the excesses for this year, particularly with the understanding that many folks on our team are underpaid relative to market.

I see three ways of doing this for an organization like ours (the letters below correspond to the letters in the diagram, above):

A: Team Incentives

Determine how much of the excess was created by each team, and distribute shares of the overall “excess pie” to those teams. Allow teams to distribute those earnings to the members of the team in a way they see fit (likely by advice and consent).

Pros

- Incents good team behavior; focusing team-members on the success of their team, and pushing each team-member to do well by their peers

- Incents good budgeting behavior; with centrally set salaries and benefits, and open controls on pricing, the main “lever” teams have in generating more excesses is smart spending

Cons

- Generates rivalry between teams

- Teams that do not directly generate excesses will likely not receive a share of the “excess pie”

Requires the ability to know who’s on which team, when, and precisely determine how much excess is created - Incents bad resourcing behavior; doing more with less earns more profits but is likely to dissatisfy employees and customers (though this is somewhat self-regulating)

- Decreases value of the company by removing profit

B: Individual or Group Performance Incentives

Determine how much of the excess was created by each individual, or how much of the excess was created by the group. Distribute a share of the “excess pie” on either an individual or group basis, or a combination of the two.

Pros

- Individual Reward high-producing star performers

- Group Reward collective achievement

- Individual Easy to calculate; use salary data as a proxy for contribution to the “excess pie,” and divvy up the pie based on portions of the salary pool for the year

- If the differences between Capacity levels are accurate, and are all accurately assigned, then this is an ideal way to distribute excesses. All employees would receive a “bonus” as an equal share of their earned salary for the year (say, 30%)

Using this system is an endorsement of our capacity system as it is currently constructed - Group Easy to calculate; use time spent on the business for the year as a proxy for contribution to the “excess pie,” and divvy up the pie based on portions of the “time pool” for the year

- If excesses are generated by a team’s work, and otherwise impossible to create on one’s own, then a time-based system where each month worked is worth the same to all participants is likely the least worst system

- Group Others may read this differently, but our “Team” Value seems to align with this approach. “Team even at the expense of flexibility and individual recognition”

Cons

- Individual Very hard in our system to accurately measure contribution: all work, including sales, is a group effort; individuals are unable to demand our fees or fulfill our work without the structure of our business behind them; leads generated using group-developed theory and offering require attribution work; fixed-fee structures without rate cards imply shared value creation

- Individual Without high-quality data on performance, calculating individual contribution/value creation becomes a popularity/political contest, creating tension in the team

- Individual Salary may be a poor proxy for creation of excesses; possible to reward below-average performance with above-average compensation, which will create tension within the team

- Individual Advice processes for determining individual are subject to inherent bias and will miss low-visibility, high-value contributions

Group Deprioritize individual achievement; possible to reward below-average performance with above-average compensation, which will create tension within the team - Both Decreases value of the company by removing profit

C: Dividends and Stock Buybacks

For Dividends: collectively agree on an amount to distribute to Shareholders; distribute dividends on a per-share basis according to ownership percentage; organization pays taxes on profits; individual pays taxes on earnings

For Stock Buybacks: collectively agree on an amount of shares to buy back, and from whom, with the agreement or at the request of the shareholder(s); purchase shares from individual shareholders; individual pays capital gains tax

Pros

- Buybacks Affords an opportunity to resolve any ongoing inequities in ownership by “locking” any differences at a particular share price, with future growth being shared by all

- For example: Clay, Mike, Mark each sell 40,000 shares back to the business at $5 ($600,000 total spend @ $200,000 each); all founder owner stakes are set at 120,000 shares; any future growth is shared by all founders equally. This scenario represents an agreement that the excess value created by C/M/M at the founding of the business, based on their capacity, is $600,000 and no more

- Dividends Increases value of the company by recognizing profit

- Both Recognizes the contribution by all owners to the growth of the business by converting their equity into cash, particularly for those who were in “early” and have larger stakes than others on the team moving forward

Cons

- Dividends Double taxation (company and individual) on earnings means recipients get less cash

- Dividends Will end up paying some money to those not working in the business after stock has vested and employees have moved into the network

Global Finances’ Recommendation

For 2016 year end, either distribute the excesses based on Time (Group incentive) or a 50–50 split between Time and Capacity-driven calculations. What the latter says is: “Each person is nothing without the team, and the team is nothing without each person.”

For 2017, pursue a combination of plans for dealing with excesses, with the intent of having fewer excesses, generally.

- Pay higher wages, manage cash more effectively, grow the team to pursue our purpose

- Team Incentive: track excess value created and track team membership; assign the remainder of the “excess pie” to teams based on their contribution

Group Incentive: share a portion of the excesses based on time spent on the business - Beyond 2019, when the Founders’ have vested fully and many Members’ shares have vested, pursue a stock buyback from Founders to lock-in the value creation at some mutually consented level.

Comments